A new entry in NAHB’s Eye on Housing blog this week looks at what builders should expect to see happening in the marketplace once the backlog of household formations that have been delayed by the recession actually materialize.

A new entry in NAHB’s Eye on Housing blog this week looks at what builders should expect to see happening in the marketplace once the backlog of household formations that have been delayed by the recession actually materialize.

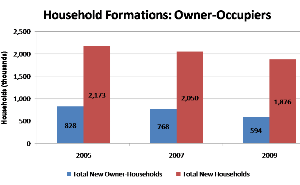

NAHB has estimated that as a result of current economic conditions, there are approximately 2.1 million households that were expected to form in the last few years but did not. These “potential” households typically represent people doubling and tripling up on roommates and young adults living with parents.

Unlocking this pent-up demand, a process that will be facilitated by an improving job market, will help reduce the excess inventory of homes.

However, given ongoing challenges associated with obtaining mortgage credit and faulty appraisals, it is incorrect to assume that all of these potential households will become homeowners. Data from the American Housing Survey (AHS) can help estimate what form unlocked pent-up demand will take.

NAHB economists point out that many of the newly forming households will initially become renters. In fact, looking at data from the government’s American Housing Survey to estimate what form the unlocked pent-up demand will take, they project that approximately 70% of these new households are likely to become renters, and that in the short-run, this could cause the national homeownership rate to fall. However, this effect will likely be temporary as rental vacancy rates continue to fall, new renting households increase rental demand, rents are pushed up and more existing renters decide to become home owners. Read more on this interesting analysis in the Eye on Housing Blog, or contact Rob Dietz (800-368-5242 x8285) for additional information.